Middle East Conflict: Economic Concerns and Global Repercussions

Rising tensions in the Middle East are raising concerns about its overall economic implications. Market specialists fear collateral effects, including a possible rise in oil prices and a shift of capital to areas considered safer.

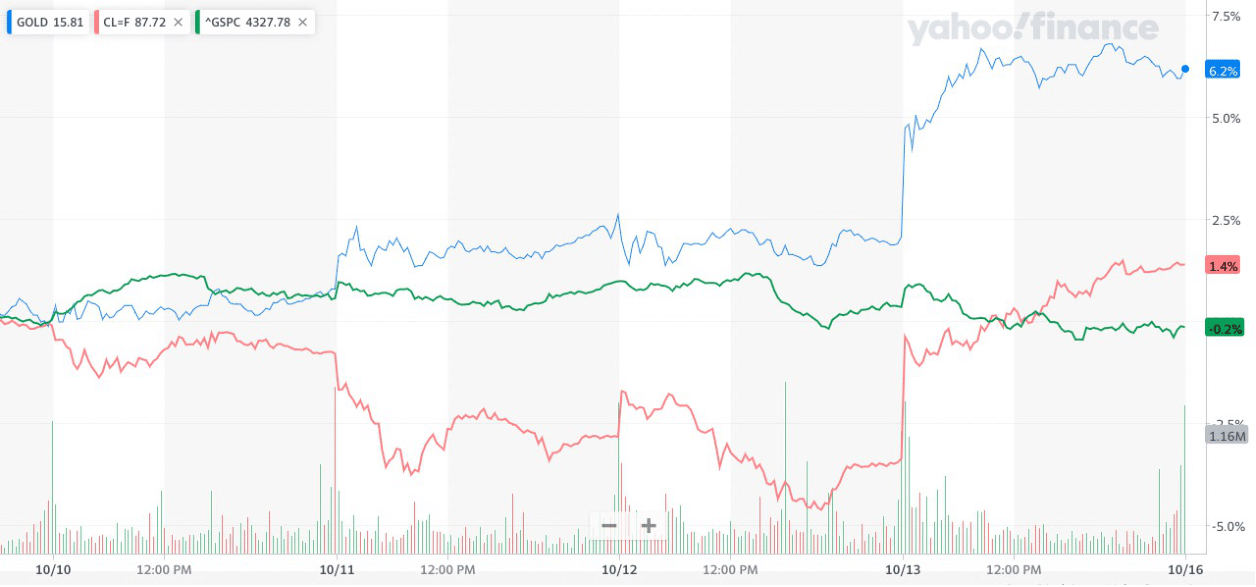

Following Israel’s announcements regarding a possible ground attack on the Gaza Strip, financial markets showed signs of nervousness. The S&P 500 fell 0.3% this week, while oil and the US dollar saw their values increase. Even more notable, the price of gold experienced a sudden increase of 6%.

If the conflict were to spread, experts, including Michael Englund and Bernard Baumohl, anticipate higher global inflation and rising interest rates. However, the United States could stand out, being seen as a haven for investment in times of crises.

Ben Cahill of the CSIS (Center for Strategic and International Studies) warns of the risk of neighboring countries becoming involved in the conflict, thus exacerbating the situation. Despite these concerns, the direct impact on American consumers, particularly with regard to gasoline prices, could remain moderate in the short term.

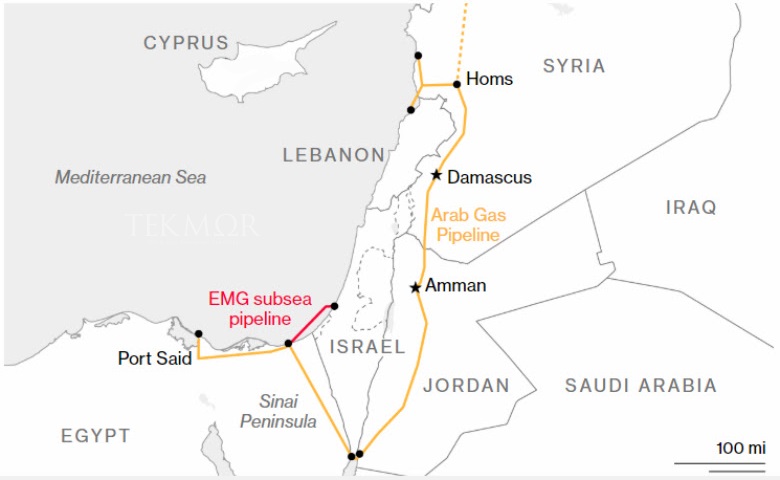

Other fuels could also be affected, as recent events such as Chevron’s halt to natural gas exports via a major undersea pipeline (EMG pipeline) from Israel to Egypt have shown.

Understanding Primary, Secondary, and Commodities Markets:

The Primary Market is where new securities are issued to the public for the first time, often during events like an Initial Public Offering (IPO). Its main purpose is to allow companies or governments to raise capital. In this market, there’s a direct issuance of new securities, and the funds raised go directly to the issuer.

The Secondary Market comes into play after securities are issued in the primary market. In this market, these securities are traded among investors. Platforms like the NYSE or Nasdaq are part of the secondary market. Its primary function is to offer liquidity for existing securities and to help in determining their market prices. Unlike the primary market, the original issuer doesn’t receive funds from these transactions.

The Commodities Market is distinct from the previous two. Here, raw, or primary products, such as gold or wheat, are traded. Commodities can be categorized as hard, for example minerals. Besides commodities can be also categorized as soft, like agricultural products. They are traded either for immediate delivery, known as the spot market, or for future delivery, known as the futures market.

The most important to understand is that while the primary and secondary markets are based around securities, securities are negotiable financial instruments, the commodity market is all about raw materials, this is the basic definition. Each of these markets plays a crucial role in the broader financial landscape.