The 2024 US Presidential Election holds significant global implications, with the potential rematch between President Joe Biden and former President Donald Trump drawing international attention. The outcome will influence key global issues, including trade policies, environmental strategies, and international diplomacy. Financial markets worldwide are closely monitoring the election, as the future president’s policies will impact global economic dynamics. This election transcends national boundaries, shaping the United States’ international role and its interactions with other nations on critical global challenges.

Historical Context and Market Dynamics

Historically, while presidential elections tend to introduce a degree of short-term volatility to the stock market, over the long haul, it’s the broader economic fundamentals that play a more pivotal role in shaping market trends. However, the upcoming 2024 election is poised to be an outlier in this regard, primarily due to the starkly contrasting policy visions offered by the potential candidates. This contrast is likely to introduce a layer of uncertainty and opportunity that market participants need to navigate. Additionally, the current global geopolitical landscape, marked by heightened tensions and shifting alliances, adds another layer of complexity to the market dynamics. Investors and market analysts are closely watching these developments, understanding that the election’s outcome could have significant and potentially lasting impacts on market behavior and economic policy, both domestically and internationally.

Election-Specific Considerations and Their Market Impact:

1) Fiscal and Tax Policies:

The 2024 election could usher in significant changes in fiscal and tax policies, directly impacting the stock market. If the Republicans win big, we might see more tax cuts and a push for deregulation, potentially boosting sectors like finance and energy due to improved profit margins and reduced regulatory burdens. On the other hand, a Democratic win could lead to increased investments and focus on sectors like renewable energy and healthcare, aligning with Biden’s emphasis on sustainable energy and expanded healthcare access.

2) Trade and Monetary Policies:

Trade policies are on the line in this election, especially with Trump’s proposed blanket tariffs. These policies could majorly shake up the US and global economies. Implementing such tariffs could make the US dollar stronger but might also heighten trade tensions, disrupt global markets, and add to the

unpredictability in market movements. These changes would necessitate careful navigation from investors, considering potential impacts on various sectors and the broader economic landscape.

3) Geopolitical Considerations:

The election will also have a significant say in the US’s approach to critical international issues, affecting how the country interacts with the rest of the world. Whether it’s the US’s support for Ukraine, its relationship with China, or its role in international coalitions, the election outcome could lead to substantial shifts. These shifts could send waves through global markets, affecting everything from energy prices and supply chain dynamics to overall market risk levels, highlighting the interconnectedness of geopolitics and global finance.

Three Common Myths About Elections and Investing

When it comes to investing during election years, several myths persist that can skew investor perceptions and decision-making. Here’s a clearer look at these myths based on historical data and market analysis:

Performance in Election Years

There’s a common belief that stocks tend to perform poorly in election years. However, historical data from 1928 onward shows that the average annual return for the S&P 500 during presidential election years is 7.5%, only slightly lower than the 8.0% average in non-election years. While there’s a bit more volatility in election years, especially as the vote nears, this doesn’t drastically alter the overall annual performance. In fact, once election results are in and policy directions become clearer, markets have typically rallied.

Stock returns don’t tend to differ much in election years

S&P 500 average annual price returns, 1928-2023, %

Sources: Bloomberg Finance L.P. Data as of December 31, 2023. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

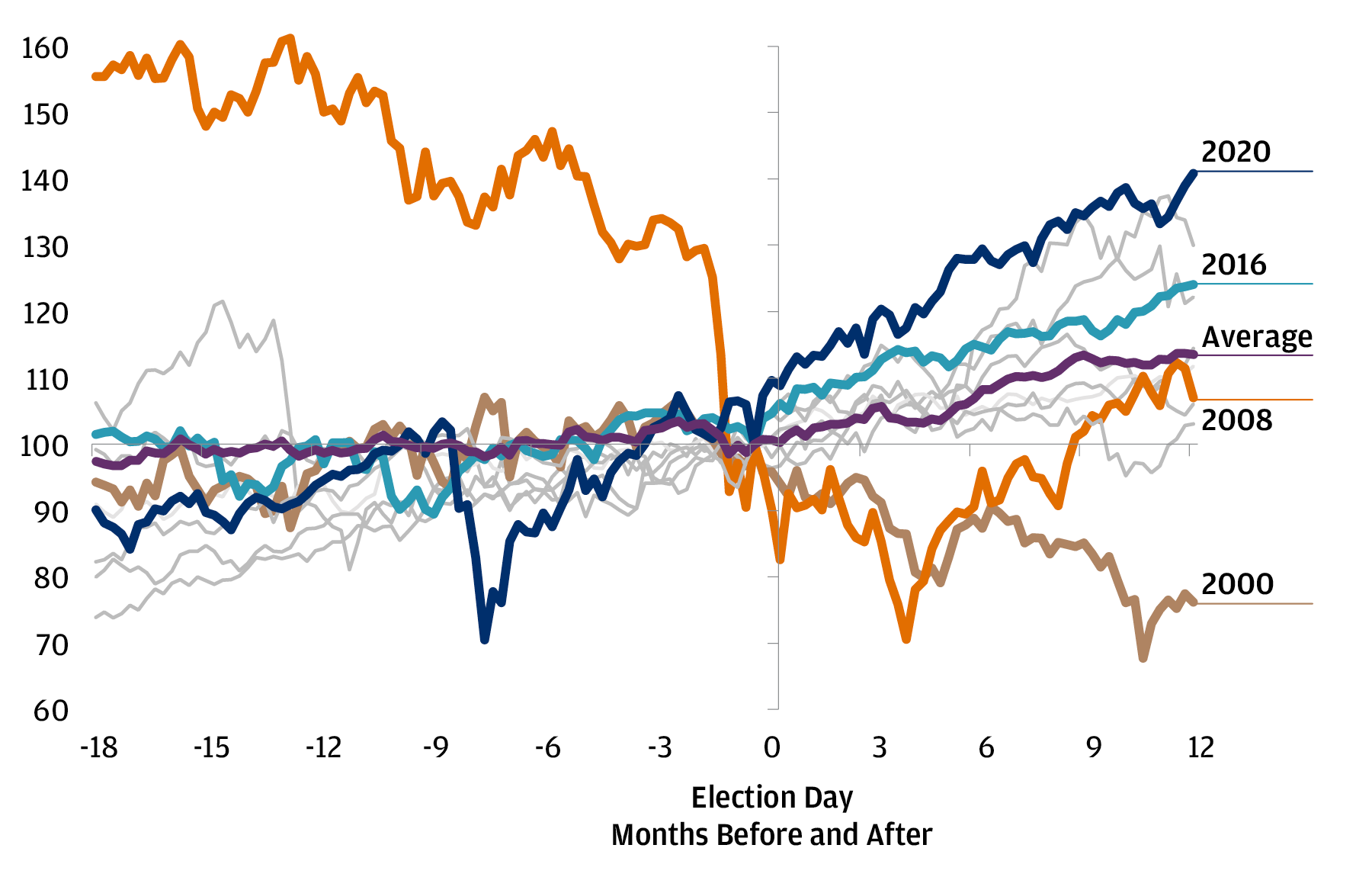

Myth 2: Market Downturns Post-Election

Another widespread notion is that if a particular candidate wins, the markets will plummet. Yet, the broader economic context at the time of the election is a more significant factor than the election outcome itself. For example, the 2020 market movements were more influenced by the pandemic than the presidential candidates’ differing policies. Similarly, the 2008 financial crisis had a more substantial impact on the market than the electoral contest between Obama and McCain. Market

downturns post-election are usually linked to imminent recessions or existing economic downturns, not merely the change in leadership.

S&P 500 moves around U.S. elections since 1984, Indexed to Election Day

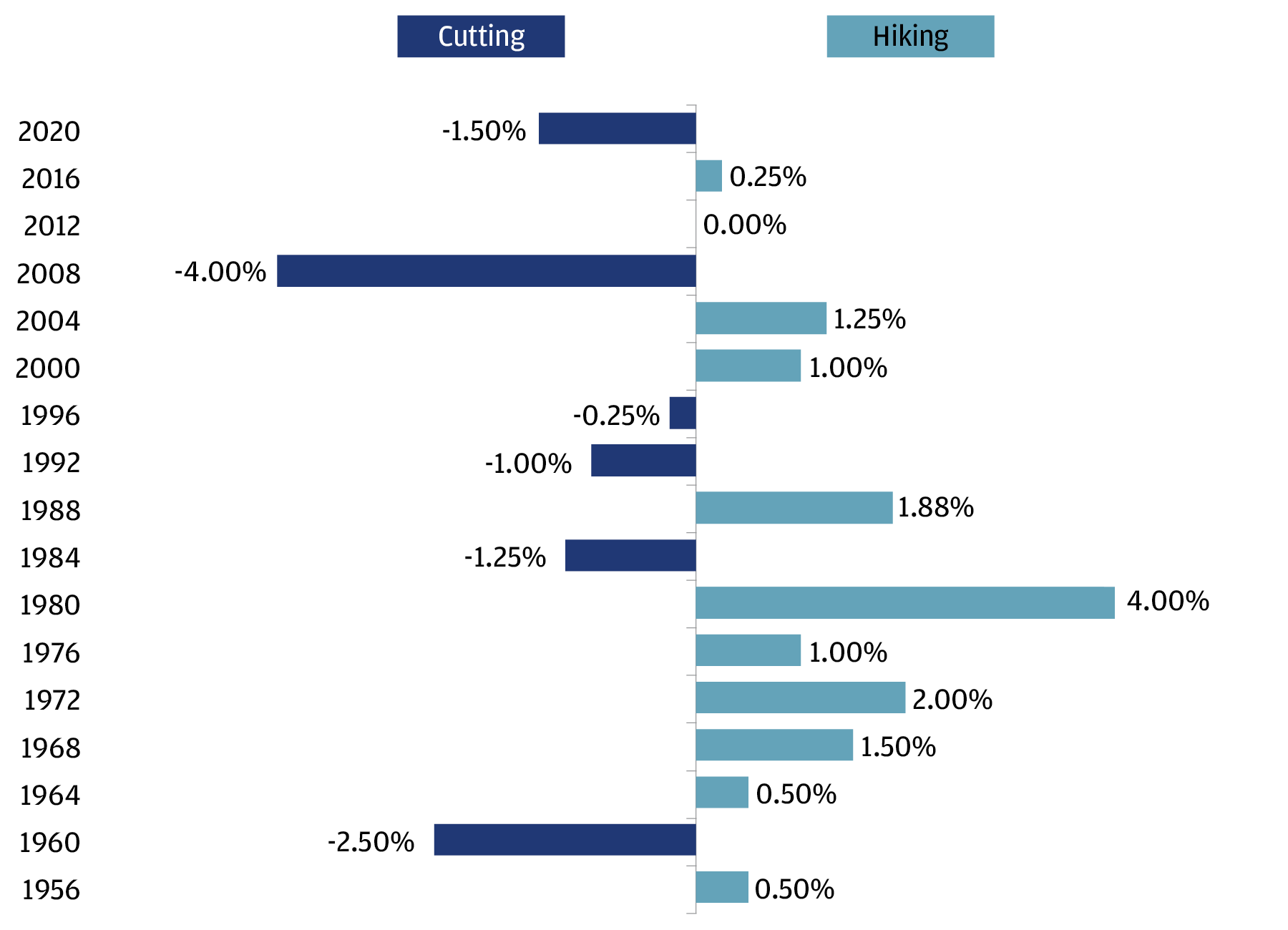

Myth 3: The Federal Reserve’s Election Year Inaction

There’s also a myth that the Federal Reserve tends to avoid adjusting interest rates during election years to remain politically neutral. However, historical records since 1956 show that the Fed has actively changed rates in nearly every election year, the exception being 2012. The Federal Reserve’s primary focus is on economic stability, not political timelines. Whether it’s raising or lowering rates, the Fed’s actions are aimed at managing inflation and fostering sustainable growth, regardless of the election cycle.

By understanding these myths and recognizing the actual drivers of market performance, investors can make more informed decisions during election years, focusing on economic indicators and long term strategies rather than short-term election-related uncertainties.

Sources: Federal Reserve, St. Louis Fed, Haver Analytics. Data uses the effective Fed funds rate from St. Louis Fed for 1954- 1968 and the Fed target policy range from 1972-2020. Analysis is as of January 18, 2023. Data rounded to nearest 12.5bps.

Conclusion

The 2024 US Presidential Election presents a complex interplay of domestic policies, international relations, and market dynamics. By integrating insights from the Goldman Sachs report with a broader analysis of historical trends and current policy discussions, investors can better understand the potential implications of the election and strategize accordingly. While the election’s outcome remains uncertain, a proactive, informed approach to investment planning can help navigate the potential market fluctuations and capitalize on emerging opportunities.