“I can contribute to your association by investing time in it. The financier in you knows that our most important asset is time.” This answer we got while we were recruiting inspired me to write a short series of four articles about time and especially its different implications in finance. Enjoy!

Compound interest

Definition

The first think I had in mind while reading this was Einsein’s famous quote “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t pays it.” An interest is the money you get when you loan some money or the one you pay when you have a debt. It is a compensation to the loaner for risk taken and the impossibility of using his money as he want. This term was extended to stock market which works more in terms of ROI (return on investment). For a bond, the owner receives a coupon which was determined when the bond was emitted. Moreover, a bond value varies in inverse proportions to the new bonds rates (if new bonds have a higher rate, it is more interesting to buy them instead of the former ones). The company from which you bought the share will give you a dividend which is not fixed but voted and the share value will fluctuate with the results of the company. It is necessary to combine all those different aspects to get the return of an asset. The adjective “compound” come from the fact that those returns do not scale linearly but exponentially along time.

Compound interest applied to students

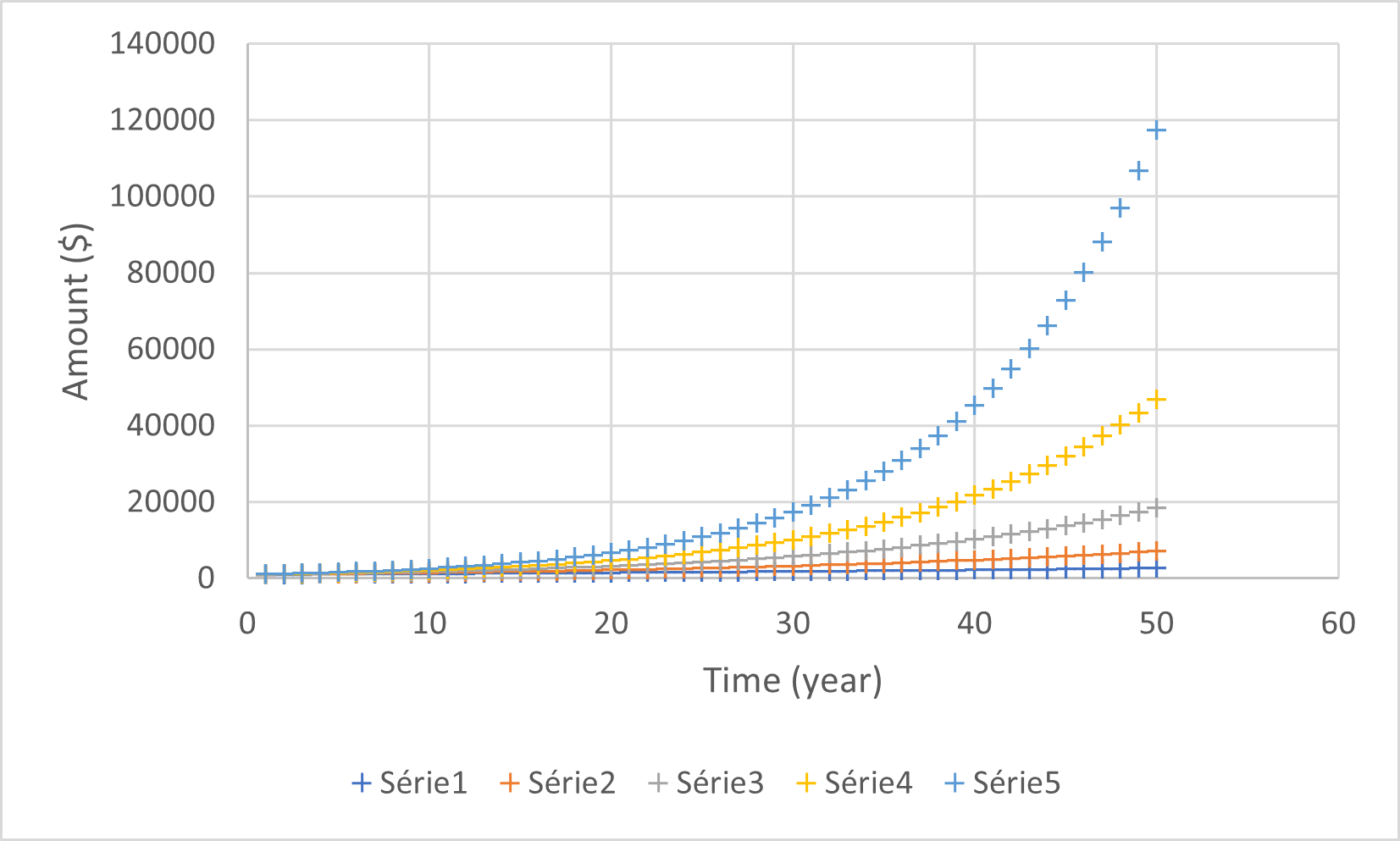

The notion of compound interest is especially important in personal investment and especially for young persons such as students. Let’s see an example to get it: do you prefer 10 million in one month or 1 cent right now, but it doubles every day for the next 30 days (and its interest too)? In the second case, you will get 10.7 million, so more than in the first one. Unfortunately, this 1 cent coin does not exist, but we can apply the same principle to more realistic return rates. For example, one can easily check the difference between several returns from 2% yearly (for fixed income) to 10% (for a more risky and active strategy). With an initial investment of 1000.-, the first strategy will give 2991.- in 50 years while in the riskiest strategy, investor would get 117390.- after 50 years. Due to exponential function behavior, the difference becomes extremely important in the last years. But is there someone illustrating this principle.

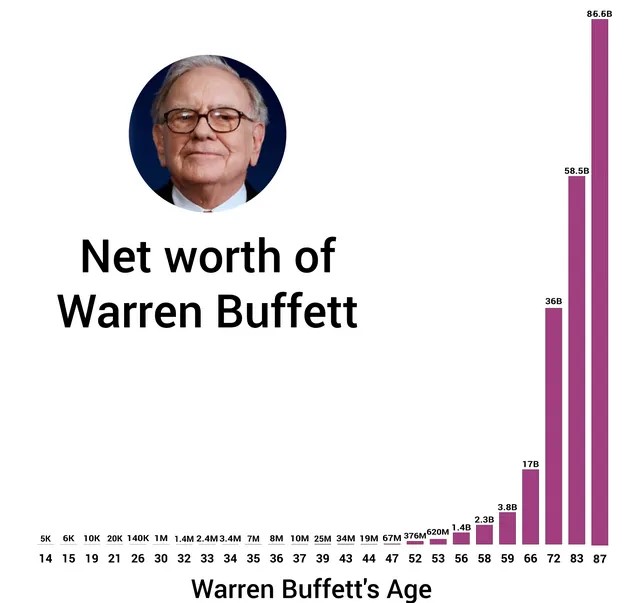

An example: the Oracle of Omaha

Of course, in finance vulgarization the compound interest return cannot be dissociated of the Oracle of Omaha: Warren Buffett. The famous value investor, chairman and CEO of Berkshire Hathaway is now 93 years old with a wealth of 113.8 billion of dollars. He is famous for starting investing at the young age of 11 when he purchased a few Citgo Petroleum Corporation stocks which means that he has been investing for 82 years. At 21, which can be the age of an EPFL student, his net worth was 20000.- which means a return of 24% per year until know. Also, he is an example of how investing for long with a high return work and can inspirate you in your investor life