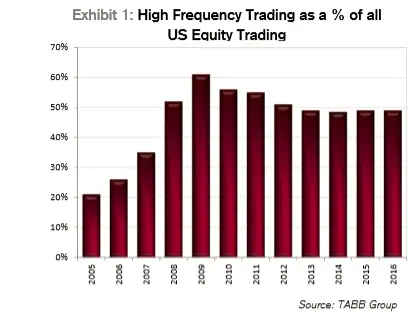

If I was asking you who are the principal actors in finance, you would probably give me some names of famous investors and portfolio managers. However, even their large trades are negligible compared to the entire market. In fact, a large share of the trades comes from high frequency trading (HFT). HFT designates the use of powerful computers to proceed complex algorithms placing thousands of orders within a second. Those algorithms analyze different market conditions way faster than a human. It results in a high turnover rate and the company with the most performant IT realizes the biggest profit. In the end, the benefit of every trade is small, but the sum of the total becomes interesting.

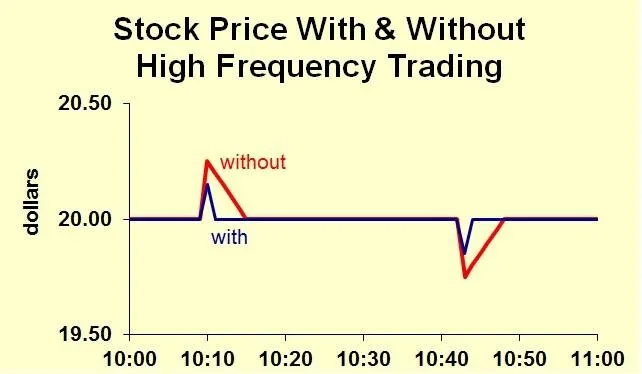

Isn’t it dangerous to let algorithms proceed half of the market? Of course, there are pros and cons. It is true that algorithms can turn wrong and increase the short-term volatility by creating a cascade effect. On May 6, 2010, the DJIA index lost 10% in only 20 minutes then recovered after a massive order that triggered a sell-off for the crash. In fact, it was no more human decision and algorithms were all selling in chain following the momentum. However, HFT also has positive externalities. The main one is that it brings liquidity to the market. The investors do not sell or purchase often, so they need traders to provide them liquidity. It results that in the long run the volatility of the market is reduced by HFT which avoids the market being influenced too much by big orders.

In fact, when buying or selling a large amount of assets, a phenomenon called slippage occurs. Slippage is the difference between the expected price and the execution price. A private investor can sell or buy stocks without having any impact because it is negligible compared to the total market.

This is not the case for a large bank or fund which has to execute an order along a wide period of time to not influence the market by creating volatility. Also, they have to execute orders while the volatility is low.

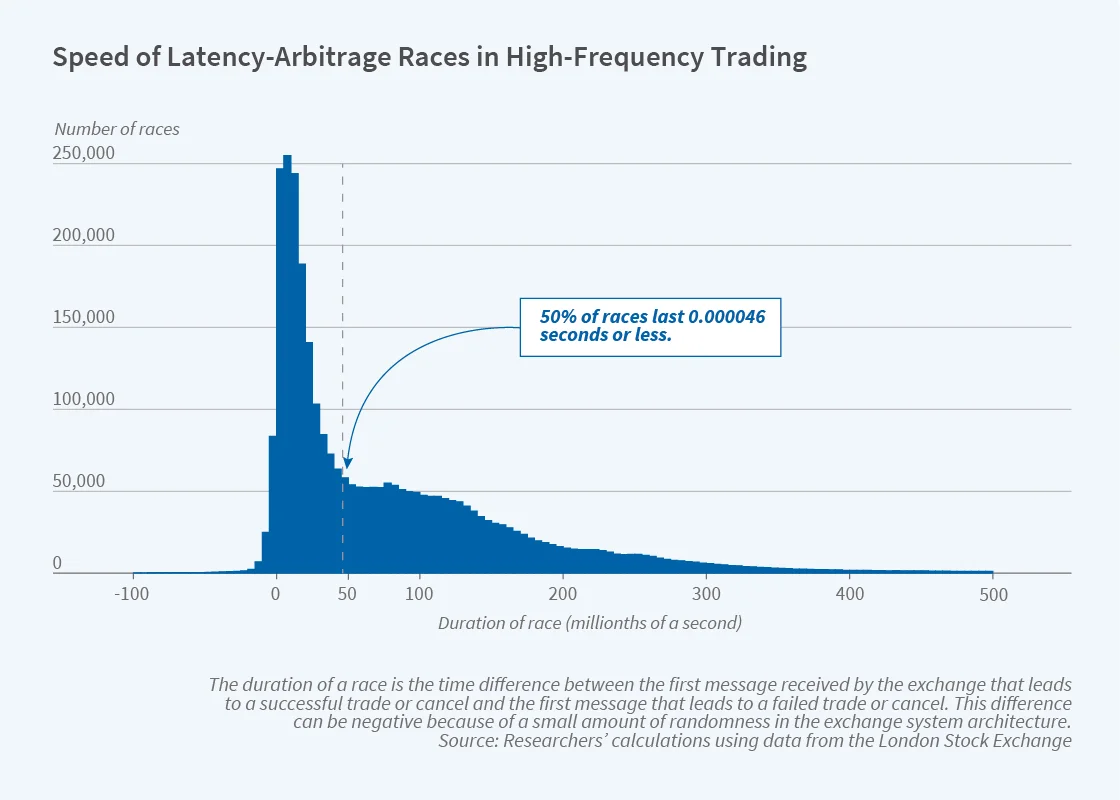

It is also an opportunity for high frequency traders. After being anticipated, these moves creating volatility will be amplified by them. For example, a main shareholder selling stocks will make the price go down. So, HFT aim is to short the asset at the same time. To do so, it is necessary to execute orders at a high speed before the other traders. At the beginning of digital exchange, the importance was to be as close as possible to the servers because the latency due to wires length was high. Nowadays, half of the orders are 0.000046 or less. This peak on the graph can be identified as the HFT part.

To conclude, HFT has pros and cons. However, it is now a big part of the market nowadays and it would be difficult and less efficient to not use it. Then, there is an asymmetry between small traders who do not have access to these infrastructures resulting in a comparative advantage for the large technological companies.

interesting article.