The Brexit decision has led to many discussions about its impact on the UK economy. We’ll explore how Brexit affects the UK, focusing on trade, migration, investment, and the broader economic consequences. Understanding these aspects helps paint a complete picture of the post-Brexit economic situation.

Brexit was a turning point for the UK’s economy. Leaving the EU in 2016 triggered years of negotiations and political turmoil, leading us to ponder the effects on trade, migration, investment, and the overall economic health. In this article, we will try to assess it’s economic impact.

We’ll dive into the effects of Brexit on trade, and we’ll see whether these effects match the initial expectations and concerns. Also, during the Brexit campaign, migration was an important issue. It has since undergone significant changes due to modified policies. We will explore how these policy shifts have influenced the UK’s labor force and demographics.

Also, investment, a key player in economic growth, has been affected due to Brexit. We’ll see how both local and foreign investments have adjusted to the new economic situation and what this means for the UK’s future. Lastly, we’ll check out the big picture, assessing how Brexit has affected the UK’s GDP and other important economic indicators.

1) Navigating Brexit’s Trade Maze: Impact and Uncertainties:

- Trade Barriers:

Brexit has been a real game-changer for the UK’s economy. It completely changed the way trade is done between the UK and the European union. As the UK redefined its ties with the EU, one immediate and very noticeable change was the introduction of some major trade barriers between the UK and the rest of Europe. These trade barriers have had quite the impact, and they’re pivotal in understanding how Brexit has shaped the Britain’s economy.

- Decline in Trade Intensity:

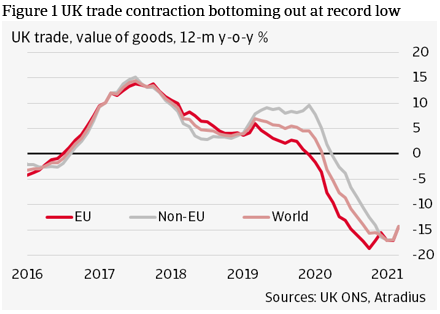

The numbers are striking: The Office for Budget Responsibility (OBR) points out a big drop in the UK’s ‘trade intensity,’ which measures how much trade contributes to the economy. This drop is more significant than what many other advanced countries have seen and it has wide-ranging effects on different parts of the economy.

When experts look at this, they consistently link it to Brexit. A study by Du et al. in 2023 shows that UK goods exports have taken a big hit, especially for smaller businesses. Plus, research from Bailey et al. (2023) tells us that new trade barriers are causing serious problems, especially for smaller companies involved in manufacturing supply chains.

- Complex Trade Patterns:

But, it’s important to look closely at the data. Surprisingly, the trade figures from the Office for National Statistics (ONS) don’t exactly match the simple trade models’ expectations. While we might have expected a big drop in UK-EU trade, the reality is more complex. Goods trade has weakened, but services trade is holding up (ONS 2023). There’s not much difference in how UK exports to the EU compare to exports outside the EU, although smaller businesses are feeling the impact more (Freeman et al. 2022).

Understanding this complexity is a challenge. Traditional trade models don’t fully explain how Brexit has changed the UK’s role in global supply chains (Baldwin 2014). On the other hand, the resilience of service exports is because the UK is strong in high-value sectors like consultancy, where trade barriers are less important. The global trend toward remote service delivery, accelerated by the pandemic, is also helping (Hale and Fry 2023).

This complex puzzle leaves us with questions. We can say that Brexit has affected how the UK trades, but we’re still figuring out the full extent and the exact reasons behind these effects. It’s a sign of how Brexit keeps reshaping the UK’s trade landscape.

2) Brexit and Immigration: Unanticipated Outcomes

1) EU Migration Shift:

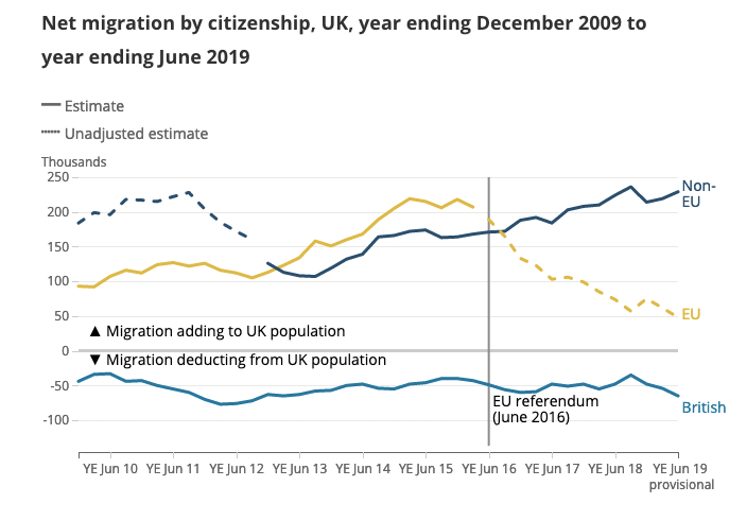

Brexit instigated profound alterations in the UK’s immigration landscape. These consequences are not only substantial but also layered with surprises and nuances that warrant closer examination. The most evident change was the tightening of labor supply due to the end of free movement. Net immigration from the European Union, which once exceeded 200,000 individuals annually, has now turned negative. These shifts have had far-reaching implications across sectors and the UK’s labor market.

2) Economic Impact and Sectoral Variation

As anticipated by experts, the primary impact didn’t manifest as a substantial wage increase, but rather as rising prices and reduced output in affected sectors. The adjustments and challenges stemming from reduced migration flows have affected different sectors divergently. Intriguingly, wage growth has been more pronounced in sectors less directly impacted by these changes.

3) Unexpected Changes and Future Prospects

Surprisingly, immigration from outside the EU has remarkably increased, offsetting the decline in EU migration. Many factors, including more flexible post-Brexit immigration policies, refugee flows, and growth in international student numbers, have contributed to this phenomenon. While not all these factors can be linked directly to Brexit, this shift in the nature and national origin of migrants aligns with the new immigration policies. Short-term economic challenges in sectors adapting to the end of free movement are expected to be counterbalanced by long-term benefits of transitioning toward more selective and higher-skilled migration. Whether these expected benefits will materialize is yet to be determined, but Brexit’s impact on immigration is undeniably more intricate than a mere reduction in EU migration.

Brexit’s Impact on Business Investment in the UK

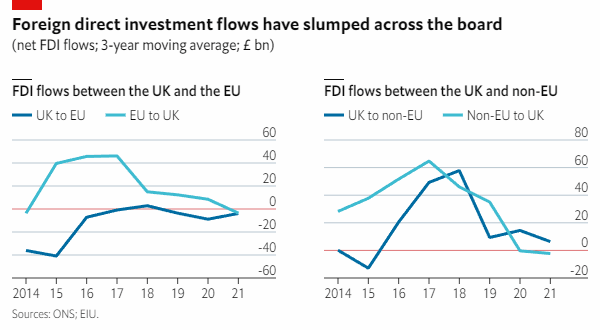

Brexit significantly affected the UK’s economy. While we often think of Brexit’s effects on international trade, it’s important to recognize that it also affects a critical element of economic growth: business investment. After the 2016 referendum on EU membership, business investments in the UK remained low. The COVID-19 pandemic made things worse, and it took until the end of 2022 for investments to recover to pre-pandemic levels. Brexit played a role in this slow recovery, impacting the country’s economic size and future growth.

Business investments, as measured by the Office for National Statistics, include various things like buildings, equipment, and research and development. These investments contribute to economic growth. To understand Brexit’s impact, we can look at the sharp drop in investment growth after the 2016 referendum. This drop helps us see how Brexit affected this crucial economic measure and its broader impact on the UK economy.

1) Is the slowdown in UK business investment growth due to any particular industries?

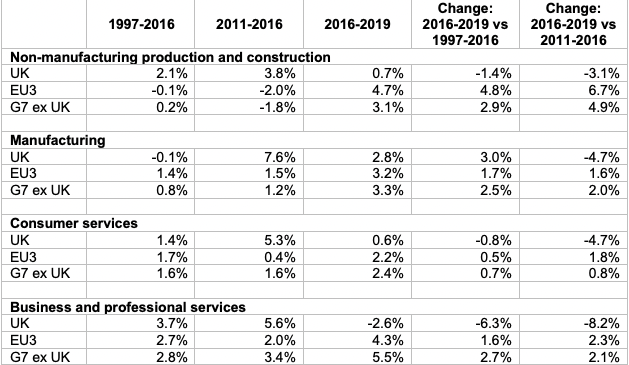

One interesting part of looking at the slowdown in how businesses invest money in the UK is checking if it’s happening more in some industries. We want to see if it’s because of Brexit or if it’s because of other things specific to certain industries.

Table 1 shows us how investment growth in four big industry groups changed before and after the important Brexit vote in 2016. It also compares the UK to other big countries in the G7. What we see is that in all of these industry groups, the UK’s investment growth went down more after 2016 compared to other G7 countries and the years before the vote. One thing to note is that the business services industry, which includes things like transport, technology services, finance, and office services, had the biggest drop.

These findings show that the slowdown in how businesses invest money is happening all over the UK, and it’s likely because of Brexit. It’s not just one industry; it’s happening in many of them. And since different areas in the UK rely on different industries, this has important effects on how Brexit is impacting different parts of the country.

Table 1: Average annual growth rates of investment by industry group, UK and comparator country groups

Source: OECD

2) The Ripple Effect of Weaker Business Investment

Reduced business investment has broader effects than just company finances. Even a small decrease can have significant and lasting consequences for the entire country.

To understand these consequences, we need to compare what’s happening now to what might have happened without the slowdown caused by Brexit. Official data shows a 4% increase in investments between mid-2016 and the end of 2022. But if we look at what could have happened without the slowdown, we see a 9% increase. Economic models show that for every 3% more investments, the economy grows by 1%. So, our analysis suggests that in 2022, the economy could have been 1.3% bigger with the extra investments we expected in our “what if” scenario. This means the economy could have been £29 billion larger. If you split this among all the households in the UK (about 28 million of them), it’s roughly £1,000 per household in 2022.

These findings match up with what other experts say about how Brexit affects the economy. The Office for Budget Responsibility (OBR) thinks that UK productivity could drop by about 4% by the end of the 2020s, mainly because of less trade (import and export) by around 15%. Other groups like the Treasury and the Bank of England agree, showing that business investment is closely linked to other important economic things.

Conclusion:

In conclusion, Brexit has undeniably impacted the UK’s economy, affecting trade, immigration, and business investment.

Trade relations have seen a decrease in trade intensity, particularly in goods, but service exports and the UK’s changing role in global supply chains add complexity.

Brexit’s end of free movement resulted in increased immigration from outside the EU, aligning with the new immigration system’s objectives.

Business investment has slowed post-Brexit, impacting the country’s capital stock and GDP, with a potential annual loss of £29 billion.

Understanding these multifaceted consequences goes beyond numbers; it affects households, businesses, and society. The path forward holds uncertainties but also opportunities for shaping the UK’s post-Brexit economic future.

Mohamed Hedi Hidri, 20 Oct 2023

References

Bank of England (2023), “Monetary Policy Summary and Minutes of the Monetary Policy Committee”, June 2023.

Du, J, E Satoglu and O Shepotylo (2023), “How did Brexit affect UK trade?”, Contemporary Social Science 18(2): 266-283.

Freeman, R, K Manova, T Prayer and T Sampson (2022) “UK trade in the wake of Brexit”, CEP Discussion Paper 1847.

Fry, E and S Hale, S (2023) “Open for business? UK trade performance since leaving the EU”, Resolution Foundation, February.

Gudgin, G, and S Lu (2023), “The CER doppelganger index does not provide a credible measure of the impact of Brexit”, UK in a Changing Europe Working Paper 5.

Haskel, J and J Martin (2023), “How has Brexit affected business investment in the UK”, Economics Observatory, March.

OBR – Office for Budget Responsibility (2023), “Economic and Fiscal Outlook”, March.

ONS – Office for National Statistics (2023), “UK trade”, April.

Springford, J (2022) “The cost of Brexit to June 2022”, Centre for European Reform, November.

UK in a Changing Europe (2019) “The economic impact of Boris Johnson’s Brexit proposals”, October 2019.

UK in a Changing Europe (2023), “Exploring Bregret: Initial Polling”,

UK in a Changing Europe (2023b), “Immigration after Brexit”, February.