S&P raises Greece’s debt rating:

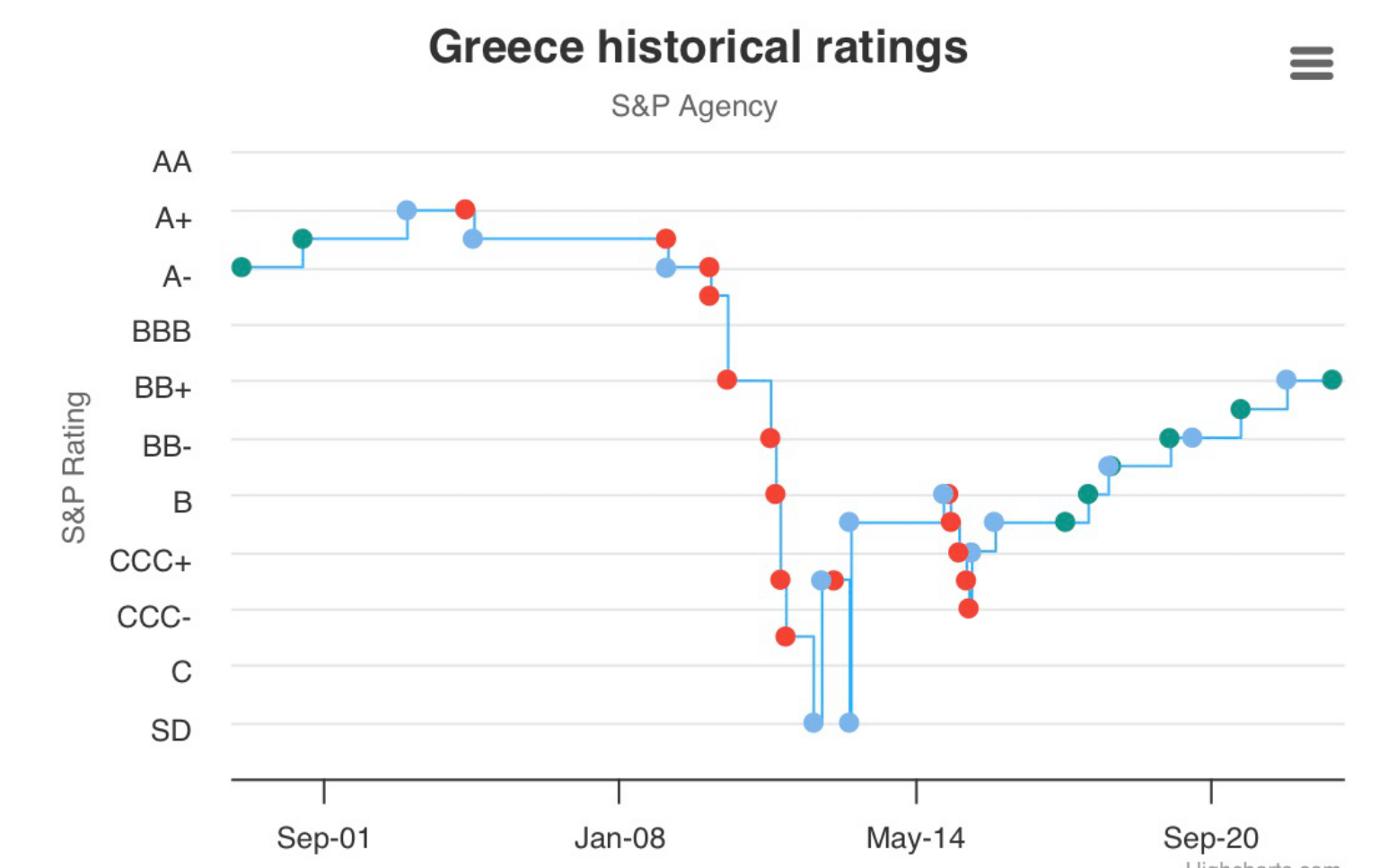

On October 21, 2023, the renowned financial rating agency, S&P Global Ratings, elevated Greece’s credit rating from BB+/B to BBB-/A-3. This notable shift categorizes Greece’s debt as an “adequate investment,” a status it hadn’t achieved since before the 2010 debt crisis.

For Greece, this progression in credit rating symbolizes a significant recovery, especially considering the frequent downgrades it experienced during its economic downturn. To stave off a potential economic implosion between 2010 and 2015, Greece was backed by three bailouts amassing 289 billion euros. This substantial amount was closely supervised by both the EU and the IMF, with the nation’s debt peaking at 300 billion euros.

Prime Minister Kyriakos Mitsotakis of Greece had ambitiously hoped for such a turnaround, marking Greece’s regained creditworthiness. He described this upgrade as a crucial juncture, emphasizing his government’s unwavering resolve to implement reforms, bolster growth, and attract investments.

Although Greece’s government is committed to upholding a fiscal discipline, targeting a primary balance surplus of 0.7% of its GDP this year, S&P predicts this figure could ascend to 1.2%. On the economic growth front, there’s optimism too. Following a robust 5.6% growth rate in 2022, the government aims for a 1.8% growth in 2023, escalating to 3.0% by 2024. Contrarily, S&P projects a 2.5% growth for 2023.

In essence, S&P’s rating upgrade underscores Greece’s economic resurgence. This move is expected to lead to more attractive financing terms and play a pivotal role in the nation’s long-term debt mitigation strategy.

Financial rating agencies:

Financial rating agencies, including Standard & Poor’s, Moody’s and Fitch Ratings, largely dominate the market for assessing the default risk of businesses, states and local governments. They assign grades ranging from A to D, with intermediate levels, to inform investors. However, their scoring methods remain confidential.

The origin of these agencies’ dates to John Moody, who founded the first rating agency in 1909 following the 1907 banking panic in the United States. Their business was primarily focused on selling documents on the financial condition of companies until they began assigning ratings to emerging financial products in the 1970s. Investors then began to rely on these ratings to make investment decisions because they had neither the time nor the desire to examine these complex products in detail.

However, since the financial crisis of 2008, these agencies have been the subject of much criticism. Their opacity, their lack of accountability and their alleged role in the aggravation of the crises have been singled out. They have become dependent on the big banks that issue these financial products, because they risk losing important customers if they give poor ratings.

This reliance has raised concerns about their ability to anticipate and assess all risks in an ever-changing market. Companies are now scrambling to get good marks by adapting their practices, which can lead to a loss of innovation and economic stagnation. Some economists believe that growth relies on innovation, but without taking risks, this innovation is compromised, which hinders growth.

Ultimately, modern finance seems to respond more to the expectations of investors than to the needs of the real economy. The role of financial rating agencies and their influence on financial markets continue to be at the heart of debates on financial regulation and the functioning of the current economic system.