Shein Targets U.S. IPO Amidst Growth and Controversy

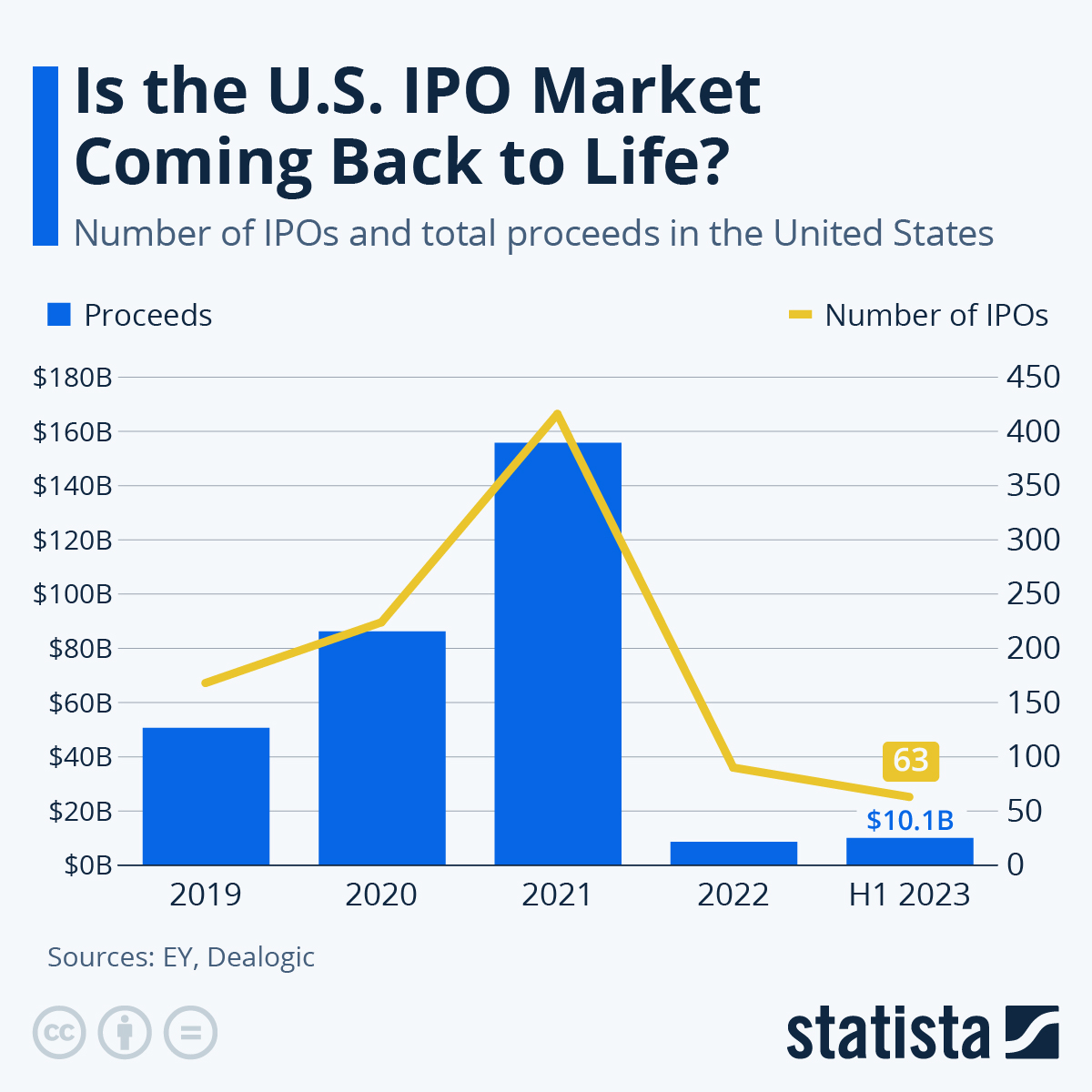

Shein, the Chinese-founded fast-fashion powerhouse, has confidentially filed for an initial public offering (IPO) in the United States, signaling a major step in its global expansion strategy. With a last known valuation at $66 billion against $117 billion for Inditex (Zara’s group) which is a main player on this market , the company aims to go public as early as 2024, according to CNBC. This move allows Shein to work closely with the U.S. Securities and Exchange Commission (SEC) to refine its filing details privately.

Despite its meteoric rise in the fashion industry, Shein has faced significant challenges. The company has been scrutinized for issues like forced labor in its supply chain, environmental concerns, and accusations of design theft. Shein’s group vice chair, Marcelo Claure, has denied some of these allegations, yet the company admits to and is addressing certain supply chain issues.

In preparation for its IPO, Shein has increased its public engagements, notably collaborating with Forever 21 and hosting high-profile events. This shift in strategy aims to reshape its narrative amidst the controversies. However, CEO Sky Xu’s low public profile stands in contrast to typical leadership visibility in U.S. public companies, adding a layer of intrigue to the company’s image.

Financial giants Goldman Sachs, JPMorgan, and Morgan Stanley have been appointed as lead underwriters for Shein’s offering, a move that brings significant financial expertise and credibility to the company’s IPO journey.

As Shein navigates these challenges and opportunities, its upcoming IPO is poised to be a significant event in the global fashion industry, potentially reshaping perceptions and market dynamics in the fast-fashion sector.

The IPO Journey: Navigating the Path from Private to Public

The journey from a private to a public company through an Initial Public Offering (IPO) is a pivotal event, reshaping a company’s future. An IPO is pursued mainly to raise capital for expansion, development, or debt reduction. It also enhances a company’s market visibility, boosts its credibility, provides liquidity for existing shareholders, and is an attractive avenue for attracting and retaining top talent through stock-based compensation.

The key advantages of an IPO include access to substantial capital, increased market exposure and prestige, diversified shareholder base, and serving as an exit strategy for founders and early investors. However, IPOs come with challenges such as being complex, costly, increasing public and regulatory scrutiny, and potentially leading to a dilution of control for original founders.The IPO process typically begins with preparation, including internal audits and selecting underwriters, followed by filing a registration statement with the SEC. After a review for accuracy and completeness, the share price is set, and upon approval, the company makes its shares available to the public.

Given the evolving capital markets, there are now alternatives to traditional IPOs, such as direct listings, SPACs (Special Purpose Acquisition Companies), and DLPOs (Direct Listings with a Primary Offering). These alternatives offer unique advantages and challenges. For instance, direct listings can save significant costs as they do not involve underwriters, and SPACs offer a faster, more cost-effective path to becoming publicly traded. DLPOs combine elements of both traditional IPOs and direct listings, allowing companies to raise capital while providing liquidity to existing shareholders.

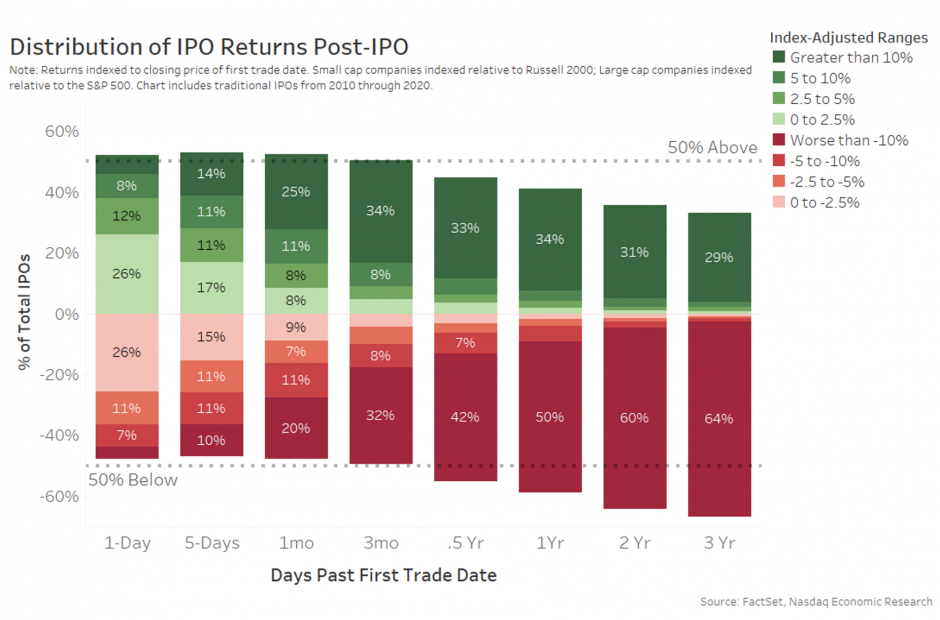

Another aspect of going public is the analysis of the long-term performance of IPOs. It’s observed that a majority of companies coming to market are unprofitable when they IPO. Despite this, their first-day return often exceeds that of profitable companies. However, over time, the actual financial results and more information help investors to reassess valuations more accurately. The long-run performance of IPOs varies significantly, with some companies significantly outperforming the market, while others underperform. Interestingly, companies with greater sales on the date of their IPO tend to perform better than those with smaller sales, regardless of their profitability status.

In conclusion, while IPOs offer numerous benefits, they come with significant challenges and alternatives. The decision to go public, whether through a traditional IPO, direct listing, SPAC, or DLPO, requires careful consideration of these factors. Additionally, the long-term performance of IPOs underscores the importance of diversification and accurate pricing for investors.